"While day by day the overzealous student stores up facts for future use, he who has learned to trust nature finds need for ever fewer external directions. He will discard formula after formula, until he reaches the conclusion: Let nature take its course." - Larry Bird

The first step to being a successful investor is to know what is and isn't an investment.

Warren Buffet stated in his 2011 "Berkshire Hathaway Letter to Shareholders": Investing is often described as the process of laying out money now in the expectation of receiving more money in the future. At Berkshire we take a more demanding approach, defining investing as the transfer to others of purchasing power now with the reasoned expectation of receiving more purchasing power – after taxes are paid on nominal gains in the future. More succinctly, investing is forgoing consumption now, to have the ability to consume more at a later date. From our definition there flows an important corollary: The riskiness of an investment is not measured by beta (a Wall Street term encompassing volatility and often used in measuring risk) but rather by the probability – the reasoned probability – of that investment causing its owner a loss of purchasing-power over his contemplated holding period. Assets can fluctuate greatly in price and not be risky as long as they are reasonably certain to deliver increased purchasing power over their holding period…"

Most believe that investments are separated into three primary groups: ownership, lending, and cash equivalents. Ownership investments include stocks, businesses, real estate, precious metals; lending investments include: savings accounts and bonds; cash equivalents include: money market funds. Typically, education or consumer purchases, such as shoes, clothing, beds, cars, TVs, and anything that naturally depreciates with use and time are not investments.

Investopedia explains: "The reason it's not technically an investment is a practical one. For the sake of clarity, we need to avoid the ad absurdity of having everything classified as an investment. We'd be "investing" every time we bought an item that could potentially make us more productive, such as investing in a stress ball to squeeze or a cup of coffee to wake you up. It is the attempt to stretch the meaning of investment to purchases, rather than education, which has obscured the meaning."

I disagree with the definitions of investment given above, not because they are wrong but that the explanations are incomplete. For me, an investment is "anything" after a period that one expects to receive a more significant return in value, than the amount that was exchanged for it. All choices should be judged by which over time would generate the highest return. However, the definition of an investment can be viewed through many lenses; an investment is forever linked to the investor’s belief, truth, and expectation. Here at LCM, we have a more progressive definition of investment; taking into account the attributes of a profitable venture:

Our formula for investment is truth + idea + vision + provision = Investment. Truth is the key element of lasting solutions and the seed of all good ideas. Ideas are the foundation of vision, and vision attracts provision, which produces an investment. Before we look deeper into a company, we first want to identify these elements within their business model.

The most successful entrepreneurs (businesses) find a problem in our society that they wish to solve or a direction that will open up new doors of business insight. You might ask how does one accomplish that feat? Well, they must search for truth; something that is false that most assume is the truth. They look for gaps in our culture or daily lives that have gone unnoticed. Once they discover this truth or hidden concept that many have misinterpreted or overlooked, they begin their process of creating a solution.

What truth did Steve Jobs uncover? Steve Jobs’ truth was that humans are innately tool builders, and with tools, our excellent gifts come to light. In an interview, Steve noted:

"I think one of the things that separate us from the high primates is that we’re tool builders. I read a study that measured the efficiency of locomotion for various species on the planet. The condor used the least energy to move a kilometer. And, humans came in with a rather unimpressive showing, about a third of the way down the list. It was not too proud a showing for the crown of creation. So, that didn’t look so good. But, then somebody at Scientific American (a magazine dedicated to reporting in science and technology) had the insight to test the efficiency of locomotion for a man on a bicycle. And, a man on a bike, a human on a bicycle, blew the condor away, completely off the top of the charts.

And that’s what a computer is to me. What a computer is to me is it’s the most remarkable tool that we’ve ever come up with, and it’s the equivalent of a bicycle for our minds.”

His idea was a personal computer; his vision was a personal computer small enough to carry everywhere and was a natural extension of an individual and integrated into every facet of a person's life. His vision of what computers could mean to humanity attracted provision (money, wealth, intelligence, human capital), which is the investment. Steve created or revealed an ecosystem or a community, a flow of uninterrupted giving and receiving.

Where there is no truth, there are no good ideas nor any enduring vision, provision or significant investment.

"I know quite certainly that I have no special talent. Curiosity, obsession, and dogged endurance, combined with self-criticism, have brought me to my ideas." - Albert Einstein

Einstein in his statement above was engaged in a process that would lead him to the truth first then ideas. Again, an investment is "anything" after a period that one expects to receive a higher return in value, than the amount that was exchanged for it. All choices should be judged by which over time would generate the highest profit.

In the past three-blog posts, we have spoken about the fact that money is currency, meaning, money or wealth is not to be built or stored, but it is to be revealed or created; ultimately it must flow. As we go through this process of re-evaluating our understanding of investing and discovering that alchemy does exist; one may ask, how can I create a flow or participate in alchemy? Let’s take a look at the process.

Socrates is one of my favorite characters throughout history, for me, he is a hero, due to his relentless pursuit of wisdom and his overall opposition to the status quo. Socrates had a core set of beliefs that were not very popular in his day. He disagreed with the Sophists and their tendency to teach logic as a means of achieving selfish ends, and even more their promotion of the idea that all things are relative. To sum up relativism rather quickly, I would say that the Sophist believes that truth was relative, that you can have "a truth" based on your perspective and someone else may have a different truth based on theirs. Socrates did not believe this; he thought that there is one truth (the truth), it was the truth that he loved, desired, and believed in and would pursue until his death.

Philosophy, the love of wisdom, was for Socrates itself a sacred path, a holy quest, not a game to be taken lightly. He believed or at least said he did in the dialog Meno (a Socratic dialog written by Plato); which contains references to the eternal body of all knowledge. We, unfortunately, lose touch with that information once we are born, because of the schism created by an infinite being entering into time. However, the immortal body of knowledge is seared upon our souls. Therefore, we need to remember what we already know; we must re-discover (rather than learning something new), this is called innatism. Innatism is a philosophical and method doctrine that holds that the mind is born with ideas, knowledge and that therefore the brain is not a "blank slate" at birth. Plato and Descartes are prominent philosophers in the development of innatism and the notion that the mind is already born with ideas, knowledge, and beliefs. Both philosophers emphasize that experiences are the key to unlocking this knowledge but not the source of the knowledge itself. Primarily, no knowledge is derived exclusively from one's experiences. Although individual human beings vary due to cultural, racial, linguistic and era-specific influences, innate ideas are said to belong to a more fundamental level of human cognition. Rene Descartes theorized that knowledge of God is inherent in everybody as a product of the faculty of faith.

"The air is full of ideas. They are knocking you in the head all the time. You only have to know what you want, then forget it, and go about your business. Suddenly, the idea will come through. It was there all the time." - Henry Ford

As we discussed in “Alchemy of Finance II,” the finiteness of our mind has to break into bite-size pieces the vastness of the universe into past, present, and future to digest it. Remember time (temporal, natural) sits inside the vastness of eternity (eternal, spiritual), where all things are all at once and live forever. Therefore all experiences in the natural are subject to change, and in those experiences, the opposite experience is forever present.

Socrates said that he did not teach, but instead served, like his mother, as a midwife to the truth that is already in us! Making use of questions and answers to remind his students of knowledge is called maieutic (midwifery), dialectics, or the Socratic method. I believe Socrates, Plato, and Descartes understood that learning came from info derived from experience, or information that comes from outside inward. Discernment is to differentiate, to distinguish, to perceive, which is an internal process where the data itself is derived from the inside (the eternal body of knowledge).

We also see this truth displayed in the bible. Through the first man Adam. Adam did not learn, he discerned. He didn't have to attend school to know and comprehend life's complexities, he intuitively knew. Later, in the Bible, there’s a story that’s in the Gospels, where Jesus was traveling with his disciples into Caesarea Philippi. Jesus asked the disciples “Who do men say that I am? And they said some say that thou art John the Baptist: some, Elias; and others, Jeremias, or one of the prophets. He saith unto them, But who say ye that I am? And Simon Peter answered and said; Thou art the Christ, the Son of the living God. And Jesus answered and said unto him, Blessed art thou, Simon Barjona: for flesh and blood hath not revealed it unto thee, but my Father which is in heaven.” Jesus seems to be telling Peter, that a human didn't teach you this, neither could he, because this was information that had not been shown, understood, nor comprehended. Peter could not grasp this information within the natural prison of his five senses. This truth lay beyond and requires a stretch, a leap of faith. Peter downloaded this information from another place, from the eternal body of knowledge of God.

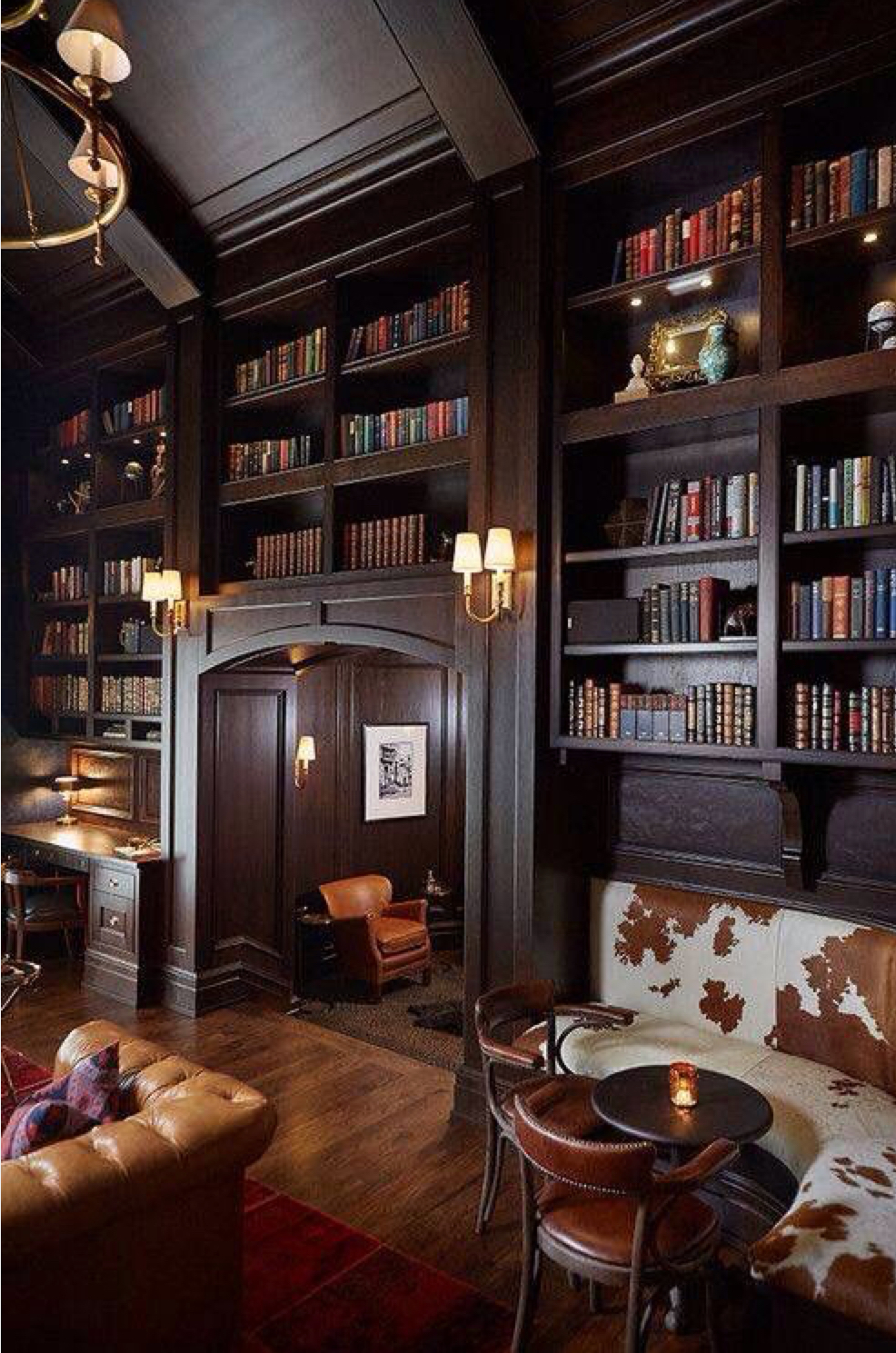

Think of the eternal body of all knowledge as a limitless library of blueprints. These blueprints hold the truth of the origin of all things; which allows us to see the spiritual truths that undergird the natural ones. We call them principles, which are correct in all seasons and situations. For example, the principle, “do unto others as you would have them do unto you." Over time, this will always work out better than its opposite. There are also absolutes, over time: justice is still superior to injustice, truth over a lie, character over charisma, etc.

The truth about investing is that it is more of a spiritual endeavor than a natural one. It is a relentless pursuit of truth. Of course, you must study and learn, but more often than not you must discern. Do not search for businesses that are profitable alone. You must go more in-depth, look for companies that you can understand their business model (blueprint) and its origins, and then you look for principles (spiritual trues) that undergird the natural ones because over time they will always win.

However, time is finite and must be digested by organizing information into cycles of past, present, and future, but this library is limitless not confined by these cycles, but constant.

Socrates had a similar understanding and shared Jesus’ quest for truth. Remember, Jesus famously stated, “You shall know the truth, and it shall set you free.” Truth is the key to freedom and the seed of all good ideas. Ideas are the foundation of vision, and vision attracts provision, which produces an investment.

Actual investment is whatever you give your being to, and your capital should be an extension of that truth. We all should invest in things that we believe we know, a truth. Anything else is pure speculation, and it’s void of any lasting meaning.

Author: Marcus A. Turner